Banks, investment firms, stock trading organizations, and other large-scale financial institutions all have an ever-increasing amount of visual data to analyze. There’s a whole litany of operation centers that help power financial institutions starting chiefly with Security Operations Centers (SOCs) that monitor the security of each physical location. Network Operations Centers (NOCs) are used to keep a constant watchful eye on network stability and integrity. More specialized facilities like Fraud Detection Centers can’t afford any detail to slip through possible cracks as they remain vigilant for suspicious activity among customer accounts and transactions.

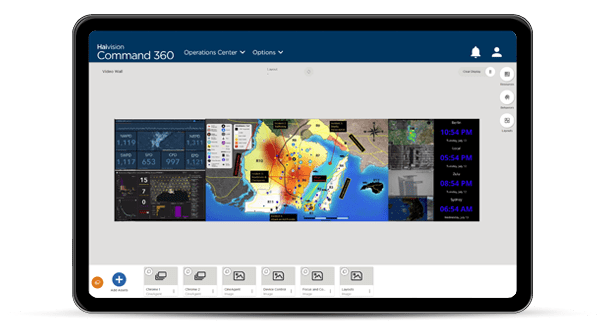

So, how do you further empower the data visualization systems in these ops centers? You give the operators in these spaces simple and stable access to the applications they need, even remotely when necessary.

If the COVID-19 pandemic has taught the financial sector anything, it’s that the show must go on even under sudden lock-down. In a worldwide event, all teams must operate as close to peak efficiency as possible. By this point, we’ve all found ways to manage working from home or within an operations center that’s only half staffed to meet social distancing guidelines. These new practices may work for many organizations, but what can a NOC, SOC, Fraud Detection Center, or other data visualization center do to keep their facilities up and running?

The answer lies within capabilities that extend full functionality for all workstations and remotely connected devices. Devices like CineAgent help reduce the strain on workstation computers by hosting vital local and web-based applications on dedicated servers designed to access these apps in seconds. This helps operators in a NOC quickly access the tools that monitor network integrity by keeping them open around-the-clock instead of as needed. Fraud detection and security operations centers also rely on their own suite of applications to readily track intrusions and incidents.

The ability to access crucial applications is vital to day-to-day operations and unforeseen, future issues. Operations centers for all financial institutions can stay ahead of the curve by keeping the digital tools they depend upon easy to access for operator and key stakeholders alike. Contact us to learn more about how cutting-edge visualization technology enhances operations for the financial sector both on-site and remotely.